Make your plan work for you

We know staying healthy and having access to the best doctors matters — so does doing it affordably.

Annual Benefits Enrollment is your opportunity to choose from our variety of health plans offering comprehensive care, all designed to meet your needs without spending more than you need to.

Annual Benefits Enrollment for 2026 is October 6-24, 2025.

2026 Annual Benefits Enrollment virtual Teams Live events

Attend our virtual Teams Live events to learn more about your options and get your benefits questions answered.

To join a virtual Teams Live event:

- Accept an invitation for an event that works best for your schedule

- When it’s time to attend the event, open the Outlook invitation and click “Join the meeting now” in the body of the invite

- Click “Join now” in the event prompt

- You’re in! Listen, learn and then complete your enrollment

| CITY | DATE | TIME |

|---|---|---|

| Whole Life with Long Term Care webinar (hosted by Kinnect BRG) | 10/01/2025 | 12:00-1:00 p.m. (CT) |

| Whole Life with Long Term Care webinar (hosted by Kinnect BRG) | 10/01/2025 | 5:00-6:00 p.m. (CT) |

| United Informed Choice PPO webinar (hosted by Aetna) | 10/06/2025 | 12:30-1:30 p.m. (CT) |

| ALL Teams Live event | 10/08/2025 | 5:00-6:00 p.m. (CT) |

| ALL Teams Live event | 10/10/2025 | 9:00-10:00 a.m. (CT) |

| ALL Teams Live event | 10/14/2025 | 11:00 a.m.–12:00 p.m. (CT) |

| HSA webinar (hosted by Fidelity) | 10/15/2025 | 9:00-10:00 a.m. (CT) |

| HSA webinar (hosted by Fidelity) | 10/15/2025 | 7:00-8:00 p.m. (CT) |

| ALL Teams Live event | 10/20/2025 | 1:00-2:00 p.m. (CT) |

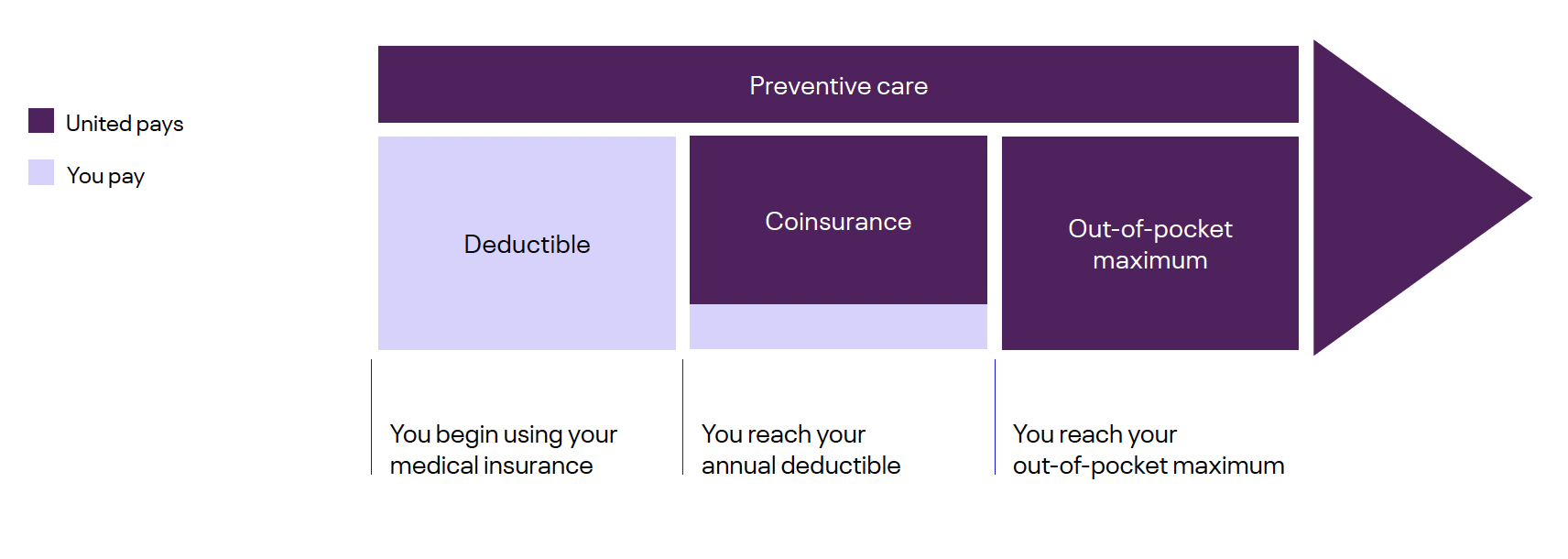

Understanding the plan terms and specifics

Deductible

The amount you are responsible for paying before the plan begins to pay a percentage of covered expenses. Typically, if you select a higher deductible plan, it means you’ll pay a lower monthly premium.

Coinsurance

The percentage you pay for covered services or prescription drugs after you have met your deductible.

Preventive care

Annual preventive visits and age-appropriate screenings are always covered at 100% for all plan options.

Out-of-pocket maximum

The most you’ll have to pay for covered medical expenses in a plan year; after you meet this amount, the plan will cover any additional eligible expenses at 100%.

Copay

A fixed amount you pay for covered services or prescription drugs, typically at the time you receive the services.

Premium

The amount you pay per month for your health insurance plan. You continue to pay the premium even after you’ve met your deductible.

Who pays and when

New benefit offerings

We’re committed to continue investing in quality programs to support your wellness. In that spirit, we’re proud to announce our new partnership with Lyra. Mental health can affect how we show up in the workplace, at home and everywhere life takes us. Lyra offers comprehensive, supportive solutions personalized to both employees and their families including self-care, individual, couples and family therapy.

Lyra, mental health and Employee Assistance Program (EAP)

United has partnered with Lyra Health to offer all United employees comprehensive mental health and EAP services. Lyra offers 24/7 access to self-care tools, no-cost therapy and mental health coaching sessions to you, your spouse/qualified domestic partner and your dependents.

With Lyra, you have:

- Access to a care navigator for individualized treatment coordination on your mental health journey

- Eight (8) confidential and complimentary coaching and/or therapy sessions for you or your eligible family members, including evening and weekend availability to fit your schedule

- Access to on-demand resources for managing stress, improving sleep and strengthening relationships as well as financial/legal support and other professional consultations

- Care for the whole family, as Lyra’s Coaching for Parents program connects caregivers with specially-trained parent coaches to help navigate challenges like tantrums, picky eating, sleep issues, arguments, technology use and more

- Specialized providers for children and teens to receive age-appropriate and compassionate care. Teens also have the option to utilize digital self-help resources, educational content and book their own appointments

Services offered through Lyra are available now. Visit lyrahealth.com/united.

For more information about Lyra and other benefits available through Wayfinder, go to YBR > Flying Together> Employee Services> Wellness-Physical, Emotional and Financial (Wayfinder).

Maven, women’s and family health benefits

Maven is a flexible women’s and family health solution that delivers in-depth care from family planning through midlife.

With Maven, you have:

- All-inclusive virtual access to doula support for labor and delivery

- 24/7 connectivity to doulas who are ready to answer questions and support expecting mothers and families

Services offered through Maven will be available starting January 1, 2025.

For more information about Maven, go to mavenclinic.com/join/UnitedAirlines.

Choose from six different types of health plans

All these plans offer prescription drug coverage, a network of reputable doctors and hospitals, access to virtual primary and mental healthcare, an on-call medical concierge, and free health and wellness tools.

-

NEW PLAN OFFERING FOR 2026

United Informed Choice Preferred Provider Organization (PPO)The United Informed Choice PPO includes tools and services that simplify every step — making it easy to find top-performing doctors at a transparent and affordable price.

- This plan uses Aetna Smart Compare® to designate quality and efficient providers in your network. You’ll pay less for office visits when you choose these providers, with no coinsurance or deductibles that apply

- The plan offers access to Aetna’s full national network, along with additional savings when choosing designated Quality and Effective Care providers

- Aetna Smart Compare® uses Intelligent Matching to connect you to in-network providers who meet your needs, along with expert guidance and personalized support

- $500 flat copay for hip, knee and shoulder replacement surgeries with designated Quality and Effective Care providers

- Features some of the lowest premiums, plus lower out of pocket costs when using Smart Compare recommended providers

-

Preferred Provider Organization (PPO) with an HSA

The United Savings PPO offers the most freedom when it comes to choosing the doctors and hospitals you want to use both in- and out-of-network at one of the lowest premiums of all the plans. It’s a high-deductible health plan that works with an HSA account that is yours for life.

- You are responsible for paying an annual deductible before the plan starts to pay for a percentage of covered costs

- HSA funds can be used to offset your deductible and out-of-pocket costs

- United deposits money into your HSA after completion of your annual physical

- United provides $3,000 in Critical Illness Insurance at no cost to you

- The Core HDHP also offers an HSA. Eligibility for the Core HDHP plan is available on YBR during enrollment

-

Preferred Provider Organization (PPO)

The United PPO, United Informed Choice PPO and the United PPO 1250 offer the ability for you to use both in- and out-of-network doctors, specialists and facilities.

- Like the United Savings PPO, but without an HSA

- Features some of the highest premiums with lower out-of-pocket costs

- You generally save money when you stay in-network with a PPO plan

- Eligibility for the Core PPO and Traditional PPO plans is available on YBR during enrollment

-

Exclusive Provider Organization (EPO)

The Centivo Platinum Plus EPO, the United Silver Plus PPO and the Bronze EPO offer lower premiums and out-of-pocket costs than our PPO plan options, but limit you to providers within an exclusive network of doctors, hospitals and specialists that meet the highest quality and cost standards. There are no out-of-network benefits, except in the case of an emergency.

- Smaller network of doctors and hospitals

- The Centivo Platinum Plus EPO plan is available in select zip codes in parts of CA, CO, CT, FL, NJ, NY, PA, including areas surrounding DEN, EWR and LAX and MCO

- Eligibility for the Core EPO plan is available on YBR during enrollment

-

Health Maintenance Organization (HMO)

The HMO plans offer the benefit of lower premiums and generally predictable out-of-pocket costs for individuals willing to work closely with their primary care physician (PCP) to manage their health. HMO options are available to employees within defined states.

- Available in CA, CO, DC, GU, GA, HI, IL, MD, OR, TX, VA, or WA*

- Copays may be lower than with other health plans

- This may be a good option for those with multiple or complex health issues

*Based on workgroup and/or your work location. Visit YBR during Annual Benefits Enrollment to confirm eligibility.

-

NEW PLAN OFFERING FOR 2026

Kaiser HSA Health Maintenance Organization (HMO)This plan features a Health Savings Account (HSA), a tax-advantaged savings tool you can use to pay for covered medical expenses. You are responsible for your deductible and coinsurance up to the out-of-pocket maximum, but HSA dollars can help cover these costs.

- United will contribute to your HSA for being up-to-date with your Kaiser physician’s recommended screenings by the deadline. To earn the United HSA incentive, you must have all 4 of the following biometric screenings up to date as recommended by your physician by March 31, 2026: blood pressure, Body Mass Index (BMI), blood glucose, and total cholesterol. Credit for these activities can only be earned when they are completed at a Kaiser Permanente facility.

- The HMO plans offer the benefit of lower premiums and generally predictable out-of-pocket costs for individuals willing to work closely with their primary care physician (PCP) to manage their health. HMO options are available to employees within defined states.

- Available in CA, CO, DC, DE, MD, or VA*

- Copays may be lower than with other health plans

- This may be a good option for those with multiple or complex health issues

*Visit YBR during Annual Benefits Enrollment to confirm eligibility

Before selecting a plan, ask yourself:

• Do you need help selecting the plan right for you?

• Do you go to the doctor often?

• Are you good at saving and don't have a lot of healthcare needs outside of your annual physical?

Before you enroll:

Use these tips and resources to make the best decisions that will benefit you and your family all year long.

- Actively enroll in order to elect a Health Care Flexible Spending Account (HCFSA) for 2026

- Remember the wellness credit and spousal surcharge 2025 elections roll over to 2026

- Starting October 6, 2025, through YBR, you can review your personal coverage, plan details and compare health plan premiums

- Access YBR through Flying Together > Employee Services > Health & Insurance (YBR), or go to benefits.ual.com

- Download the Alight mobile app and opt in to text messages to receive updates and confirmation texts whenever you make benefit changes

- Go to your “Your Profile” on the Alight mobile app, click “Manage Communications” and ensure delivery is marked “Yes” next to “Text Messages for Benefits”

Why an HSA might be the way to go:

An HSA (Health Savings Account) is a tax-advantaged savings tool you can use to pay for covered medical expenses. You are responsible for your deductible and coinsurance up to the out-of-pocket maximum, but HSA dollars can help cover these costs. This option is specific to the United Savings PPO, Kaiser HMO HSA and Core HDHP.

Some of its many benefits include:

Low premiums

No "use it or lose it" rule for money in your HSA account

Triple-tax savings, as long as you use your HSA for eligible healthcare expenses

Funds roll over from year to year, and the money is yours to keep even if you leave United or retire

You can change how much you contribute to your HSA via payroll deductions at anytime

Automatic Critical Illness Insurance is included in the United Savings PPO

Earning wellness incentives up to $800 for individuals, $1,600 for families after you receive your annual physical by the deadline ($750/$1,500 is automatically funded if enrolled in the Core HDHP plan)

Triple-tax savings.

With an HSA, your money goes in tax-free, earns interest tax-free, and is tax-free when you withdraw money — as long as you use for eligible healthcare expenses. You can roll over funds from year to year, and the money is yours to keep even if you leave United or retire.

Your contributions to your HSA are taken out of your paycheck before taxes are calculated. This lowers your taxable income and reduces your tax burden.

Keep in mind, if you elect to use the HSA investment platform, there is a nominal service fee you are responsible for paying. However, gains on your investments are tax-free.

Eligibility deadlines for earning United HSA contribution

United Saving PPO plan:

If you’re currently enrolled in the United Savings PPO plan: Complete your physical by December 31, 2025.

If you’re new to the United Savings PPO plan in 2026: Complete your physical by March 31, 2026.

If you are currently enrolled in a United PPO or EPO plan and want to switch to the United Savings PPO with an HSA plan, your physical exam from those plans in 2025 will count toward your 2026 HSA requirement.

Kaiser HSA HMO plan:

If you’re new to the Kaiser HSA plan in 2026: Complete your physical and recommended biometric screenings by March 31, 2026.

- You must have all of the following screenings up-to-date date as recommended by your physician: blood pressure, Body Mass Index (BMI), blood glucose, and total cholesterol. Credit for these activities can only be earned when they are completed at a Kaiser Permanente facility.

If you are currently enrolled in another Kaiser plan and want to switch to the Kaiser HSA HMO plan, you will receive credit for provider-recommended screenings completed under your current plan. You have until March 31, 2026 to catch up on any out-of-date screenings.

A few ways you might use an HSA:

If you’re anticipating a big healthcare expense in the future, such as having a baby, an HSA is a good strategy for setting aside money, so you don’t have to worry about unexpected expenses later.

If you were previously spending $300 a month on your monthly premiums, but the United Savings PPO has reduced that amount to $200, you can apply your monthly savings to your HSA to offset your deductible or out-of-pocket costs on a pre-tax basis.

No “use it or lose it” rule for money in your HSA account. If you plan on changing jobs or using the money next year, your HSA will always be there. It is a rollover account, which means unused funds are never lost and are tax-deferred.

How Flexible Spending Accounts (FSAs) can help you save:

An FSA provides you with a tax-free way to set money aside and pay for healthcare expenses that are not covered under the medical, dental or vision plans and/or pay for dependent care expenses.

How it works: FSAs allow you to contribute a portion of your salary to:

A “general-purpose” Health Care FSA (HCFSA) can be used to reimburse you for eligible healthcare expenses, such as medical, dental, and vision expenses. If you enroll in a health plan other than the United Savings PPO, Kaiser HSA HMO or Core HDHP, you will be eligible to contribute to a limited-purpose HCFSA for 2026.

A “limited-purpose” Health Care FSA (HCFSA) can only be used to reimburse you for eligible healthcare expenses for certain unreimbursed dental and vision services. If you are enrolled in the United Savings PPO, Kaiser HSA HMO or Core HDHP, you will be eligible to contribute to a limited-purpose HCFSA for 2026.

A Dependent Care FSA can be used to reimburse you for qualifying childcare and other dependent care expenses.

A few things to keep in mind with FSAs:

If you decide to contribute to an FSA, your contributions will automatically be made on a pre-tax basis from your paycheck and deposited in your FSA account.

After you elect to contribute to an FSA, your total annual contribution for the year will be divided into payroll deductions among the remaining payroll periods for the 2026 calendar year.

The maximum annual amount you may contribute to each FSA varies each year and is determined by the IRS.

Only the employee may enroll in an FSA, but you may submit eligible expenses you have incurred for care provided to your eligible dependents for reimbursement from your FSA.

You will be reimbursed for eligible healthcare and dependent care expenses that you have incurred upon your submission of a claim for reimbursement, along with the required documentation.

The entire amount of your annual contribution election to your Health Care FSA (reduced by previous reimbursements) is available to you at all times during the calendar year. You may submit a claim for reimbursement of a healthcare expense even if you have not yet contributed enough to cover the entire amount of the claim submitted.

Your Dependent Care FSA is limited to the amount you have contributed to date. If you have expenses greater than the amount accumulated in your Dependent Care FSA, they will be reimbursed automatically as additional contributions are credited to your FSA and you do not need to resubmit your claim.

All FSA accounts have a “use it or lose it” rule — funds don’t roll over from year to year. Any unused balance at the end of the plan year is forfeited, so be sure to use your funds before the year ends.

Explore your options. Enroll with confidence.

Let’s compare plans

Have you checked in on your wellness?

Be sure to check out Wayfinder Wellness by United, your one-stop-shop for all physical, emotional and financial wellness programs we offer to find out about benefits you may not even know we have! Wayfinder’s dedicated microsite is within YBR (Flying Together > Employee Services > Wellness- Physical, Emotional and Financial (Wayfinder)) and customized to you based on which health plan you’ve selected.

Did you know?

Dependents are generally eligible for our wellness programs offered within Wayfinder. Explore each condition-specific page for more information on eligibility.

What’s yours with Wayfinder

Your health and well-being matter — and our commitment goes beyond the doctor’s office. Through resources like Wayfinder, United continues to be your home for tools and programs to help with everything from cost savings, to prescriptions, to wellness and more.

-

Accolade is your first point of contact for healthcare needs, from finding a primary care doctor, to managing a chronic condition, or helping to sort through medical bills.

*Access to this program is determined by your plan enrollment

-

Work with a certified financial coach to help with budgeting, debt management, saving and investing.

*Access to this program is dependent on your retirement plan enrollment. Only employees with an account balance in the United Airlines 401(k) Savings Plan or United Airlines Flight Attendant 401(k) Plan are eligible to participate in the LearnLux financial wellness program.

-

Access the country’s top hospitals and surgeons and get most, if not all, surgery costs covered including replacement or non-replacement of hip, knee, shoulder, spinal procedures, bariatrics and more.

*Access to this program is determined by your plan enrollment

-

Overcome joint and muscle pain through personalized online exercise programs tailored to your condition. You’ll also have unlimited access to a personal health coach.

*Access to this program is determined by your plan enrollment

-

Access diabetes reversal treatments that can help you get off diabetes medication, lose weight and reduce blood sugar.*Access to this program is determined by your plan enrollment

-

Connect to a leading specialist for a virtual second opinion on a diagnosis or treatment plan.

*Access to this program is determined by your plan enrollment

-

Access mental health coaching, therapy and self-help resources like meditations, videos and on-demand courses.

-

Connect with primary care providers offering same-day access via telehealth for primary, urgent and chronic care needs.

*Access to this program is determined by your plan enrollment

-

Start, continue and manage your 401(k) plan with access to trusted Fidelity advisors.

*Access to this plan is dependent on your workgroup.

-

Connect with a dermatologist who can guide you through an at-home skin cancer screening.

*Access to this program is determined by your plan enrollment

-

Access a flexible women’s and family health solution that delivers in-depth care from family planning through midlife.

*Access to this program is determined by your plan enrollment

Here’s an example of how Wayfinder works:

- Imagine your doctor recommends knee surgery.

- Log in to Wayfinder and select the Surgery tile to explore resources and support available before your procedure, including programs like Carrum Health.

- Carrum Health gives you access to some of the country’s top hospitals and surgeons, with most (if not all) surgery costs covered. Experts can guide you through your diagnosis, review alternative treatment options, and help you make a more informed decision.

Be sure to take a few minutes after January 1, 2026, to explore Wayfinder and discover the quality programs available to support your well-being.

Remember: Your interactions with third-party vendors through Wayfinder are not tracked by United. You can access vendor web pages, call them directly, and obtain vendor services with peace of mind that your personal information is secure and confidential.

Frequently asked questions

Good news — we’ve made little to no changes for 2026 as we continue to focus on your physical, emotional and financial wellness through Wayfinder.

Can I have tomorrow what I have today?

Many of the primary care and mental health providers offered in our 2025 plans will be available in-network in one or more of our 2026 plans.

Employees will have a choice between plans with a broad network and plans with a smaller network of the highest quality providers. We encourage all employees to use the Find a Doctor tool during enrollment to ensure their providers are in-network with the plan they’ve selected, even if they are electing to stay in the same plan.

Where can I learn about my plan options?

We’re committed to providing you with resources to help you make informed decisions. We’re hosting virtual Teams Live events to get your top benefit questions answered, have a provider finder tool that allows you to confirm whether doctors are in-network, and offer educational resources such as Now Boarding Benefits to provide the key benefit information all in one place.

How do networks differ across plan types? Will I have to change my doctor next year?

Nearly 100% of primary care and mental health providers offered in our 2025 plans will be available in-network in one or more of our 2026 plans. You have a choice between plans with a broad network and plans with smaller, high-quality networks. Be sure to use the Find a Doctor tool on YBR to verify if your preferred provider is in-network or to find a new provider for 2026.

What do I need to do?

Here’s a list of action items to remember for this year’s Annual Benefits Enrollment:

- Annual Benefits Enrollment for 2026 takes place October 6-24, 2025.

- Employees can find everything they need to educate themselves and enroll on YBR — there is no need to call the United Airlines Benefits Center (UABC) unless your question cannot be resolved through self-service on YBR.

- Take some time to review how much you’ve been spending on healthcare, including your monthly premiums paid typically via payroll dedication, to review if you’re in the right plan for you.

- The Alight mobile app and text messaging from the United Airlines Benefits Center (UABC) are both available, providing employees with access to their benefits on-the-go.

- The Find a Doctor tool is available on YBR to confirm if a doctor will be in-network for 2026. The tool will be available during pre-enrollment and through the enrollment period.

- Decision Guides and the Price and Compare tool will be available on YBR beginning September 29 and throughout enrollment.

What is a health concierge?

A health concierge is your personal health assistant. They can help with any healthcare needs you and your family may have. They can help you find a doctor, decide where to go for a procedure and find lower-cost options for prescriptions and other care. Your concierge can also answer health questions, as well as help you understand your benefits and check on claims. Dial the customer service number on the back of your health insurance ID card to be connected with your healthcare concierge or visit Wayfinder for more information.

I like my coverage for 2025 and would like to stay in my same plan for 2026. Do I need to do anything?

Your elections will automatically roll over to 2026 if you do not enroll before October 24 — no action is required on your part if you would like to keep your coverage for 2026.

We strongly encourage all employees to actively log into YBR and make sure your coverage still meets you and your family’s needs for the upcoming plan year. Even if you plan to keep the same coverage, it’s a good idea to confirm your providers are in-network. Please note, your Flexible Spending Account (FSA) elections do not carry over year to year.

What is a HSA? How do I know if I have one?

Think of a HSA as a way to build a “nest egg” for future health expenses. Any money you set aside each month to your HSA can be used for out-of-pocket healthcare costs within that same year or well into retirement.

As an added benefit, United will also contribute to your HSA each year, making your healthcare dollars stretch further.

Visit YBR> Spending & Savings Accounts> Manage Your Account and click on “Eligible Expenses” in the lefthand corner menu to confirm what kind of expenses would be eligible for your HSA.

You have a HSA through United’s HSA administrator if at any point you have been enrolled in the United Savings PPO or a United-sponsored health plan that included a HSA.

I’m currently enrolled or planning enrolling in the United Savings PPO with a Health Savings Account (HSA) for 2026. What do I need to do to receive United's HSA contribution of $800?

- If you are currently enrolled in the United Savings PPO plan and complete your annual physical by Dec. 31, 2025, you are eligible to earn $800 into your Health Savings Account (HSA) — $1,600 if covering yourself and any dependents.

- If you choose to enroll in the United Savings PPO plan for 2026, you must complete your physical between Jan. 1 – March 31, 2026 to earn the incentive amounts ($800 for yourself, or $1,600 for you and dependent(s)).

- If you are currently enrolled in a United PPO or EPO plan and want to switch to the United Savings PPO with an HSA plan, your physical exam from those plans in 2025 will count toward your 2026 HSA requirement. (Note: Physicals provided by Accolade Care qualify).

- You do not need to submit any paperwork to receive United’s HSA contribution. It should be deposited into your HSA account approximately 30 days after you complete your physical.

I have dependents. For our family to get the full $1,600 into our HSA by participating in the United Savings PPO, do my dependents also need to complete the physical exam?

If your spouse or domestic partner is enrolled, they must also complete their physical exam to receive the additional incentive. If only you and your dependent child[ren] are enrolled, you can complete the physical and receive the full $1,600.

I’m planning to enroll in the Kaiser HSA HMO plan for 2026. What do I need to do to receive United's HSA contribution of $800?

- If you choose to enroll in the Kaiser HSA HMO plan for 2026, you must complete your physical and recommended biometric screenings between Jan. 1 – March 31, 2026 to earn $800 into your Health Savings Account (HSA) — $1,600 if covering yourself and any dependents.

- You must have all of the following screenings up-to-date date as recommended by your physician: blood pressure, Body Mass Index (BMI), blood glucose, and total cholesterol. Credit for these activities can only be earned when they are completed at a Kaiser Permanente facility.

- If you are currently enrolled in another Kaiser plan and want to switch to the Kaiser HSA HMO plan, you will receive credit for provider-recommended screenings completed under your current plan. You have until March 31, 2026 to catch up on any out-of-date screenings.

Can my HSA be used for dental and vision healthcare expenses as well as medical?

Yes. You can use your HSA for qualified medical, dental and vision expenses.

Where can I learn more about dental and vision insurance?

Check out the Price and Compare tool in YBR to compare dental and vision options side-by-side. You’ll be able to select dental and vision insurance as you enroll — it is the final step before confirming your Annual Benefits Enrollment for 2026 in YBR.

How can I get benefits information and reminders?

Download the Alight mobile app and sign up for text messaging. The Alight mobile app gives you coverage information on demand and opting into text messages from Alight ensures you receive enrollment updates as soon as we have them.

The Alight app is available on both the Google Play and Apple App Store for employees to download to their personal devices.

- To enroll in text messaging, access YBR and navigate to the ‘Your Profile’ drop-down menu.

- Click on the “Manage Communications” option.

- Under the “General Benefits” section, scroll down to “Text Messages for Benefits.”

- Click the “Change” button, review the opt-in authorization language, check the box to opt-in and then click “Save and Return.”

- A confirmation text will be sent to you within moments to confirm you accurately signed up.

What happens if I have a dependent on my coverage who is turning 26 in 2026?

You should enroll as normal for 2026, including coverage for your dependent that will be aging out of coverage. At the beginning of the month that your dependent turns 26, the Benefits Center will send you notification that their coverage will be ending. The coverage will then run through the end of the month that they turn 26.

Once the coverage ends, your dependent will receive COBRA enrollment information. If they choose to enroll in COBRA, a separate account will be created for them and coverage will begin the day after their other coverage ended so they have no gap. After their account is created, all future communications about the coverage and billing will go to them directly. If they choose not to continue through COBRA, they will need to pick up other coverage outside of United.

I am turning 65 in 2026. How does this impact my benefits?

While you are actively working for United, Medicare will always remain secondary to your United medical plan. This means that you can decline Medicare A and B while you are actively working and continue your United plan without any penalty from Medicare.

Once you choose to separate service from United, you will need to contact Medicare to begin the enrollment process. Medicare will provide you with a CMS-L564 Form that will need to be completed to prove that you had were continuously enrolled in an active employer health plan since the date you became eligible for Medicare. If this form is completed and returned to Medicare before your start date, you can pick up Medicare B without any late enrollment penalty.

How can I tell which EPO and PPO plans are Aetna and which plans are Blue Cross Blue Shield of Illinois (BCBSIL)?

Each carrier is outlined in the maps within the Decision Guides, listed on the Price and Compare tool and within the enrollment process. The Decision Guide and Price and Compare tool are located on the welcome page when you begin enrollment for your convenience.

I noticed the Price and Comparison tool has both embedded and aggregate deductibles listed for United’s plans. What does this mean?

Embedded: All United health plans (other than the United Savings PPO and Core HDHP) have an embedded deductible where when an individual in a family plan meets the individual deductible, their insurance begins paying coinsurance for just that individual. When one or more covered family members either meet or combine to meet the family deductible, the family deductible is met and the plan begins paying coinsurance for all covered family members.

Aggregate: The United Savings PPO and Core HDHP have an aggregate deductible. With an aggregated plan, there is one deductible that applies to all covered family members. Once expenses for one person or any combination of covered family members meet the deductible, the plan begins paying coinsurance for all covered family members.

I have an HRA account and don’t know how to get reimbursed. What do I do?

You can submit claims online or swipe your Smart-Choice card to use your HRA funds. Some populations can set up automatic premium reimbursement for all three combined premiums of medical, dental and vision. Those eligible would be reimbursed for the previous month’s premiums around the 5th of every month.

Remember: If you are enrolled in a plan that has an HSA, your HRA dollars become limited use.

If I have an HRA and HSA, what do I do and how does that impact how I get my funds?

When you elect an HSA and have an HRA, the HRA dollars become limited use. This means that you will only be eligible to be reimbursed for dental and vision claims from HRA when you are enrolled in a plan for that includes an HSA.

What is the benefit of having both HSA and FSA?

One of the benefits of an HSA is being able to save and invest long-term, even for retirement. If you are looking to save money in your HSA but have children that need braces and glasses, it’s a way to use tax-free money to fund vision/dental and still save for future medical costs. Assuming you use all the FSA money, you can also contribute the maximum in both accounts which gives you higher limits.

Important dates to remember

Timeline for enrollment:

| 9/29 | Decision Guide and "Price & Compare" tool available on YBR |

| 10/6 | Enrollment begins |

| 10/24 | Enrollment ends |

| 01/01 | Your 2026 benefits begin |